What is The Favourite Fib Fibonacci retracement strategy?

Fibonacci retracement strategies help traders identify the market's support and resistance levels, trend reversal points, and entry and exit decisions. The Favourite Fib Fibonacci is a Fibonacci-based strategy that can be used across various timeframes, and it works across all the major markets of the world. In this article, we discuss everything you need to know about the Favourite Fib Fibonacci strategy.

Understanding the Favourite Fib Fibonacci Retracement

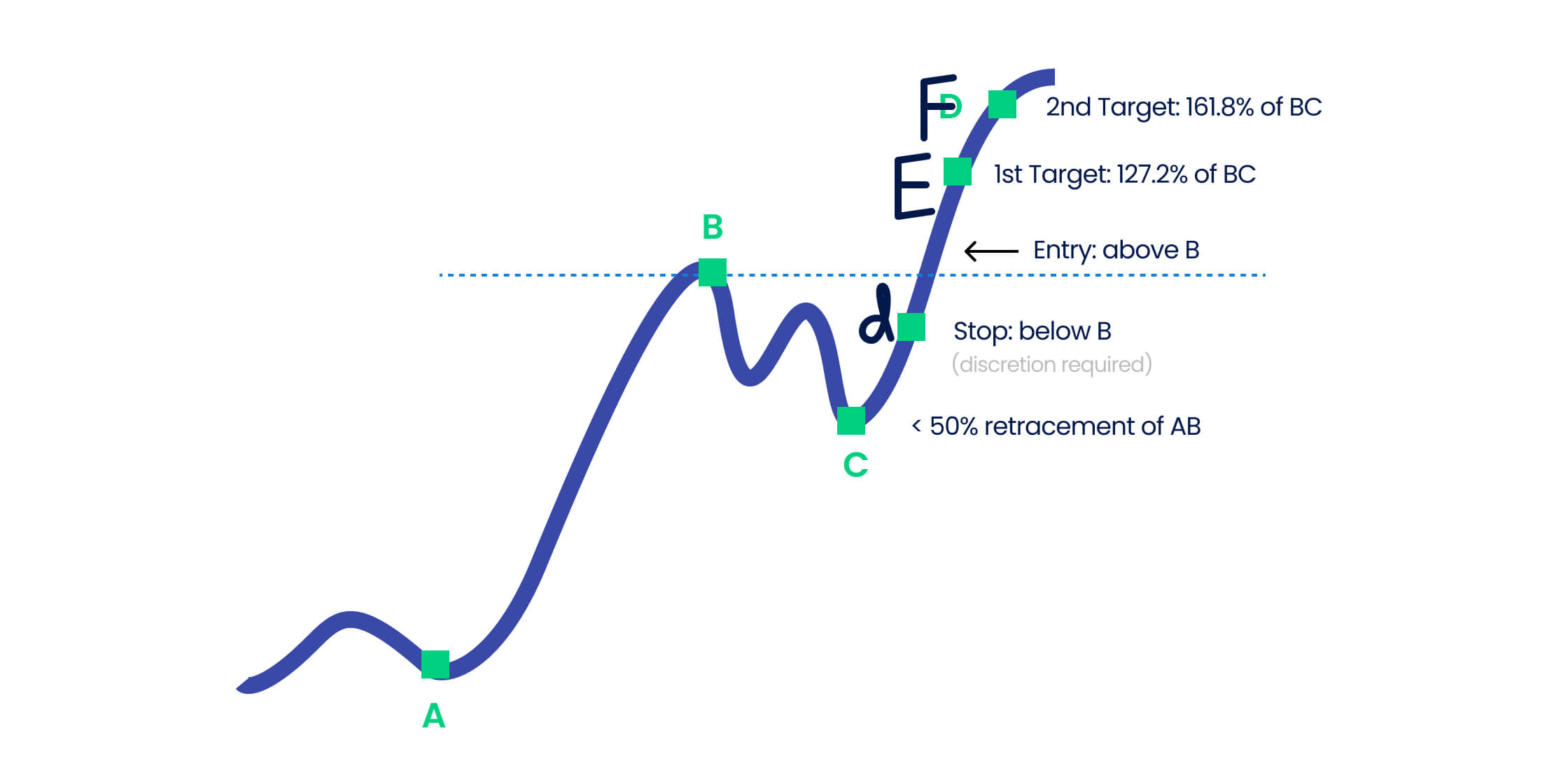

The Favourite Fib strategy is a momentum strategy that uses the Fibonnaci ratios. To use this strategy effectively, you will first need a market that has a strong and clear trend. A market that is recently hitting a multi-month high or multi-year highs or low is ideal for this. As the name suggests, the Favourite Fib strategy is purely based on the Fibonacci retracement levels. Retracement refers to a temporary change in the market direction, and the retracement levels are identified as horizontal lines indicating the exact point where a market reverses. 38.2% and 50% are considered the ideal Fibonacci retracement levels to work out the Favourite Fib strategy as these levels provide the ideal buying/selling signals. It is generally more effective on longer time charts. Most traders prefer to use this strategy for 1-hour to 4-hour charts. There are always three price swings in the Favourite Fib strategy:

- A price increase from the initial point A to B

- A price correction when the price falls for a brief time from point B to C

- A price extension after which there is a continuous increase in the currency pair prices from point C to F (and beyond)

How does the Favourite Fib strategy work?

Let's assume you are trading USD/EUR, and the currency pair is currently in an uptrend, increasing from point A ( where USD/EUR = 1) to point B (Where USD/EUR = 4), as suggested in the graph. From point B, the currency pair retraces first to a level of 3.6, then increases back to 3.8, before finally falling to point C (where USD/EUR = 2), which can also be called a 50% retracement from the original uptrend of AB. This increase and decrease in the price of USD/EUR is a result of traders taking profit by selling the currency pair in the uptrend. After point C, the market continues going in its original direction and even surpasses the original price level of 4. It continues rising beyond point D, bringing the new price of USD/EUR at 7. As per our graph, new traders can enter the trade at point B (where USD/EUR = 4), and existing traders can continue to take long positions in the currency pair at the same point B to maximise profits. Right below USD/EUR = 4, a stop-loss order can be placed at USD/EUR = 3 to minimise losses if the market reverses due to a sudden shock in the economy. The first target point should be taken above the entry point when USD/EUR = 4.25 at point E. This will be an extension level of 127.2% of the BC line. The second target is placed at a point named F, where USD/EUR = 5.2, to maximise returns. Beyond this point, the USD/EUR prices will keep increasing until they reach a resistance level.

Three important components of the Favourite Fib strategy

Entry levels: When using this strategy, the entry-level is fixed where the currency pair price is first retraced from. According to our example taken above, we consider USD/EUR = 4 as our entry price (point A) after the first retracement of 50%. (This is also applicable in bull markets). Target levels: While using the Favourite Fib strategy, a trader can target two profit levels at once. The first is the 127.2% level (at point E), and the other is the 161.8% level (at point F), which signals traders to exit before the market retraces again. Stop-loss levels: When you are in a bull market with a long position, you can place a stop-loss order some distance below the price, after which there was a market retracement (in our case, point B). Always make sure that your distance between the stop-loss and entry point does not exceed the distance between your entry price and profit target price, implying your returns to be more than your risk.

Benefits of the Favourite Fib Fibonacci Retracement strategy

1. Use with multiple time frames

It provides results in multiple time frames, from the 15-minute chart to daily, weekly and monthly charts. The higher the time frame you choose, the more effective the strategy will be, as it will allow more room for the retracements and extensions to work accurately.

2. Applicable in both bull and bear markets

It can be applied in the bull market right after positive economic news, as the prices continue to increase. Due to market movement, the price will eventually retrace to a lower level before extending to over 161.8% above the levels it initially fell to reap traders significant profits. However, when the prices continuously fall in a bear market, the currency pair price will retrace to an upper level for a brief time before it continues falling. This mostly happens immediately after a negative economic sentiment in the market. With falling prices, this strategy can be applied to short the trades.

3. Works with all instruments

Whether you are trading currency pairs, commodities, stocks or any other asset — the Favourite Fib strategy works with all kinds of financial markets as long as there is a strong trend.

Maximise your trading potential with the Favourite Fib strategy

The Favourite Fib strategy is one of the most effective and flexible Fibonacci Retracement strategies. From working in multiple timeframes to being applied to different markets, this strategy works in favour of every type of trader with all kinds of trading goals. Ready to give this strategy a try? Sign up for a live trading account or try a risk-free demo account on Blueberry Markets.

Recommended Topics

-

Guide to Utilizing a No Stop-loss Trading Strategy in Forex

Stop-loss orders can sometimes make a trade order restrictive, which could eventually lead traders to get out of a trade prematurely due to a false market signal.

-

How to Copy Trade With MetaTrader

Copy trading provides a useful way for beginner level traders to learn from experienced traders.

-

What are Forex Expert Advisors?

Forex Expert Advisors (EAs) enable the automation of forex trading.

-

How to Use The Accumulation/Distribution Indictor in Forex

The Accumulation/Distribution (A/D) indicator can determine buying and selling pressures of a currency pair as it helps identify the relationship between the currency pair's price and volume.

-

What is Commodity Channel Index?

The Commodity Channel Index (CCI) is a technical indicator that can identify overbought or oversold levels in market conditions as well as potential trend reversals and trade signals.

-

Top Fundamental Trading Strategies You Should Know

Fundamental trading strategies are popular among traders who want to make informed investment decisions based on real-world data and events rather than solely on technical analysis.

-

How to Use Martingale Strategy For Trading

The Martingale strategy acts as a popular high-risk trading strategy used in various financial markets including Forex and stocks.

-

What is The Forex Linear Regression?

Forex linear regression enables you to predict future price movements by comparing the current and historical currency pair prices.

-

Top Advanced Forex Trading Strategies You Should Know

Advanced forex trading strategies are perfect for experienced forex traders.

-

What is The Oscillator of Moving Average in Forex?

The Oscillator of Moving Average (OsMA) is a technical indicator that helps in determining a trend’s strength in the forex market.

-

What Are Bear and Bull Power Indicators?

Bear and bull power indicators in forex measure the power of bears (sellers) and bulls (buyers) to identify ideal entry points.

-

How to Trade With The On Balance Volume Indicator

The On Balance Volume (OBV) indicator analyses the forex price momentum to measure the market’s buying and selling pressure.

-

How to Use The Alligator Indicator in Forex Trading

The Alligator indicator can identify market trends and determine ideal entry and exit points based on the trend’s strength.

-

How to Use Inside Bar Trading Strategy

Inside bar trading offers ideal stop-loss positions and helps identify strong breakout levels.

-

What is the Martingale Trading Strategy in Forex?

The Martingale trading strategy increases the possibility of winning a trade in the forex market.

-

How to Use The Forex Arbitrage Trading Strategy

Forex arbitrage trading strategy allows you to profit from the difference in currency pair prices offered by different forex brokers.

-

The Beginner’s Guide to MQL5

MetaTrader, as a platform, has built-in functions that assist in technical analysis and trade management while also allowing traders to develop their own indicators and trading strategies.

-

How to Use DeMarker Indicator For Forex Trading

Every trader needs to know precisely when to enter or exit a forex market.

-

How to Use The Accelerator Oscillator For Forex Trading

The Accelerator Oscillator indicator helps detect different trading values that protect traders from entering bad trades.

-

A Forex Trader’s Guide to Awesome Oscillator

When you understand market momentum, you can better identify market reversals.

-

What is Money Flow Index?

The Money Flow Index can analyse the volume and price of currency pairs in the market.

-

What is The Ichimoku Kinko Hyo Indicator?

The Ichimoku Kinko Hyo indicator provides traders with the market’s current momentum, direction and trend strength.

-

Top Pullback Trading Strategies

Pullback trading strategies provide traders with ideal entry points to trade along with the existing trend.

-

What is High Wave Candlestick?

The High Wave Candlestick pattern occurs in a highly fluctuating market and provides traders with entry and exit levels in the current trend.

-

What is the Parabolic SAR indicator?

Identifying market trends becomes easier with the Parabolic SAR indicator as it provides the ideal entry and exit signals in strong trending markets.

-

What is Currency Correlation?

Currency correlations help trade multiple currencies in the forex market by identifying the market trends of each currency pair.

-

Price Action Trading Strategy

A Price Action Trading Strategy helps find ideal entry and exit points depending on expert opinions, news announcements, or technical indicators.

-

Average True Range

Average True Range (ATR) helps in identifying how much a currency pair price has fluctuated. This, in turn, helps traders confirm price levels at which they can enter or exit the market and place stop-loss orders according to the market volatility.

-

Moving Average Crossover

The Moving Average Crossover is a valuable tool to find the middle price-point of a trend in forex trading. When currency prices crossover their current moving averages, it helps traders identify the favorable buying or selling points for the currency.

-

What is the Bullish Engulfing Candlestick?

Bullish Engulfing Candlesticks helps in identifying an uptrend reversal in the market. This candlestick pattern stands out because a trader does not need to wait until the entire pattern is completed to enter a trade.

-

How To Trade The Gartley Pattern

The Gartley pattern helps identify price breakouts and signals where the currency pairs are headed. The pattern is also widely used in the forex market to determine strong support and resistance levels.

-

How to Trade Forex With NFP V-Shaped Reversal

A Non Farm Payroll (NFP) V-shaped reversal refers to a sudden increase or decrease in the currency pair prices right after an NFP report is released.

-

Candlestick Patterns: Top Candlestick Charts Every Trader Should Know

Candlestick patterns depict the price movement of assets in a graphical manner. Candlestick patterns also enable traders to predict market behaviour.

-

What is the Evening Star Candlestick Pattern?

Evening Star Candlestick Patterns help traders identify ideal exit levels in the forex market by signalling a slowed upward momentum and strengthened downward momentum.

-

How to Use Ichimoku Cloud in Forex?

The Ichimoku Cloud provides a clear market trend direction to the traders and helps them make market decisions accordingly.

-

Pennants Pattern: How to trade bearish and bullish pennants

Pennant Patterns work as a continuation signal in the forex market and help identify the ideal entry and exit price points

-

How to Trade Forex With Renko Charts

Renko Chart is a technical indicator that provides strong market trend directions by filtering out minor price movements

-

What are Ascending and Descending Triangle Patterns?

The Ascending and Descending Triangle Patterns confirm continued trends in the forex market.

-

How to Identify Cup and Handle Pattern in Forex Trading

The Cup and Handle Pattern is a technical price chart that forms the shape of a Cup and a Handle, which indicates a bullish reversal signal.

-

What is the Head and Shoulders pattern?

The Head and Shoulders pattern is a trend reversal indicator that predicts bullish to bearish and bearish to bullish reversals in the forex market.

-

What is the Hammer Candlestick Pattern?

Hammer Candlesticks enable traders to identify potential market reversal points, determine the ideal time to enter the market and place buy or sell orders accordingly.

-

What is The Opening Range Breakout Strategy

The Opening Range Breakout (ORB) Strategy involves taking forex positions when the currency pair prices break below or above the previous day's high or low

-

Morning Star Indicator

The Morning Star Indicator helps identify strong trend reversals in the forex market and enables you to take trade position entry decisions accordingly.

-

How Does Stochastic Indicator Work in Forex Trading?

Stochastic Indicator helps traders identify overbought and oversold market conditions that substantially lead to market reversals.

-

Heikin Ashi Candlestick Pattern

The Heikin Ashi Candlestick pattern is almost the same as the traditional candlesticks, with one big difference—the former is an averaged out version of the latter.

-

Multiple Time Frame Analysis in Forex

By monitoring different currency pairs in different time frames, you can make your Forex trades more successful and profitable.

-

What are Bollinger Bands?

The Bollinger bands can help identify overbought and oversold market conditions, protecting you against placing any orders that could lead to losses.

-

Andrew's Pitchfork Trading Strategy

Andrew's Pitchfork is a Forex trading strategy that can predict protracted market swings and help you in identifying potential market trends that can indicate potential exit and entry points.

-

Fibonacci Retracement

Fibonacci retracements are one of the most popular methods for predicting currency prices in the Forex market. Predicting upward or downward market movement can help traders with accurate price analysis for exiting or entering the market.

-

Trading in Volatile Markets

Forex volatility is the measure of how frequently a currency's value changes. A currency either has high volatility or low volatility depending on how much its value deviates from its average value.

-

The ABCD pattern

One of the most classic chart patterns, the Forex ABCD pattern represents the perfect harmony between price and time.

-

The Bearish Gartley Pattern

The Bearish Gartley pattern was introduced in 1935, by H.M. Gartley in his book, “Profits in the Stock Market”. The pattern helps Forex traders in identifying higher probabilities of selling opportunities.

-

The Bullish 3 Drive pattern

The Bullish Three Drive pattern in Forex trading is a rare pattern that gives traders information about the Forex market's potential at its most Bearish point, and in turn, suggests probabilities for a market reversal.

-

What is the MACD Indicator?

The Moving Average Convergence Divergence (MACD) indicator helps traders quickly identify short-term trend directions and reversals in the forex markets. You can use the MACD indicator to determine a currency pair price trend's severity and measure its price's momentum and even identify the bearish and bullish movements in the currency pair prices.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.