What is Margin Trading: Everything You Need to Know

Margin trading is one of the most common derivative strategies used in financial markets. It can also be considered tax-efficient as it allows you to choose the size of your wager and exempts profits earned from stamp duties and taxes. In margin trading, you do not actually own the underlying asset. You can trade with smaller amounts of capital and hold larger positions in the market by speculating on the price movements of the asset.

What is margin trading and how does it work?

Margin trading is a type of trading where traders do not actually buy or sell any assets. Instead, they only speculate on its price movement. Every spread bet includes two prices:

- The bid price at which you buy the asset

- The ask price at which you sell the asset

The difference between these two prices is called the spread. Traders who spread bets go long on the asset if they expect the market prices to rise, advice versa.

Top Benefits of Margin Trading

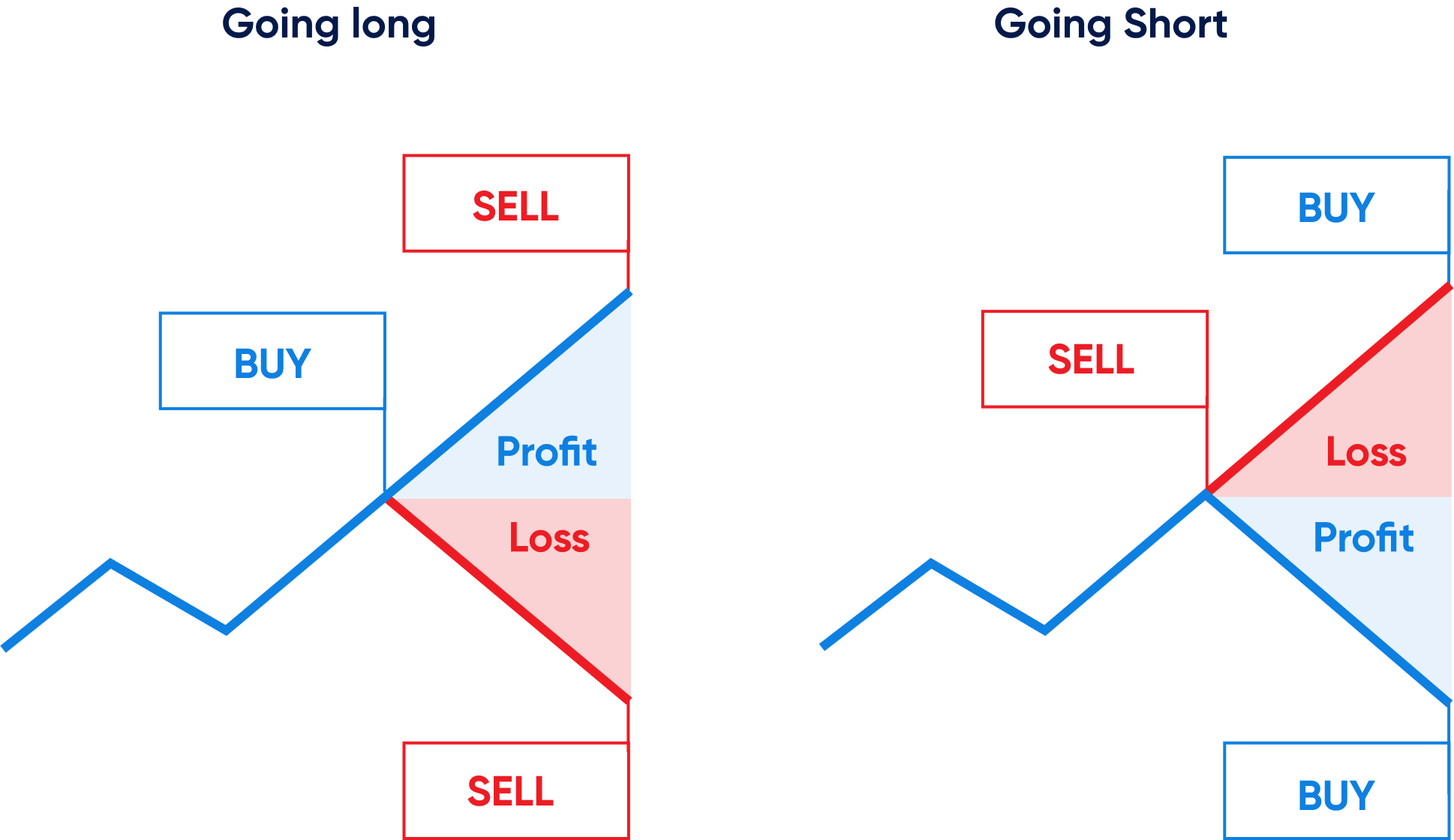

Allows you to go long or short

With margin trading, you can take advantage of both rising and falling markets. Since you only bet on the direction in which the market moves, every price movement in your favour may result in good outcomes for you.

Margin trading

You can get greater exposure in the market by only investing a small percentage of the total trade value through margin trading. For example, if you wish to place a bet worth $1,000, and your broker has a margin of 20%, you will only be required to deposit $200 to hold a $1,000 position.

Multiple market exposure

You can opt for margin trading across several markets, including Forex, Stocks, Commodities, and CFDs. Entering multiple markets may result in a number of accumulated good outcomes at the end of your trading session.

Trading off-hours

Every financial market has different trading hours. However, whenever you opt for margin trading, you can trade beyond the regular hours of trading. This allows you to strategise during the post- and pre-market sessions as well.

Hedge your portfolio

Hedging helps in offsetting risk associated with trading. You can opt to spread bet on an asset you’re expecting to move in a different direction from the Shares you own to hedge your Share portfolio. For instance, if you own Shares in a gold mine company, but its prices have been falling, you can opt to go short and offset incurred losses.

How do you manage risk in margin trading?

Standard stop-loss orders

A stop-loss order is a trade order to sell or buy an asset at a pre-decided price. It limits a trader’s risk by automatically closing a trade as soon as the price passes a certain level. A standard stop loss closes your trade at the best available price after the stop value is reached.

Guaranteed stop-loss orders

A guaranteed stop-loss order is similar to a standard stop-loss order. The only difference is that it closes a trade at the exact price you have specified. This limits losses you may have incurred and mitigates risk.

Start margin trading with Blueberry Markets

Margin trading is an efficient way to earn profits without having to pay for a large sum of money for taxes, commissions,

or stamp duties. It allows traders to speculate on the price movement of assets and place trades through margin trading.

Blueberry Markets allows you to spread bet a range of markets seamlessly on our industry-standard platform.

Sign up for a live account or try our risk-free demo account.

Frequently Asked Questions

Can you make money from margin trading?

Ideally, yes. You can earn profits from margin trading with proper experience and strategy. A systematic trading plan is needed to place successful spread bets.

Is margin trading better than CFD?

Margin trading is a tax-free trade while CFDs are offset against loss for tax purposes. This makes margin trading a more common option for traders.

What is the difference between margin trading and share dealing?

Margin trading does not involve any ownership of the securities. Hence, the trade is free from taxes, commissions, and stamp duties. On the other hand, shares trading involves having direct ownership of the asset. You are also required to pay taxes, stamp duties, and commissions.

Recommended Topics

-

Habits of Forex Traders

Forex trading requires discipline, focus, and a strong understanding of market trends.

-

Forex Trading Opportunities When Markets are Closed over Weekends

The forex market can be operated 24/7 Monday to Friday.

-

How to Calculate Forex Position Sizing

Each trader in the forex market defines their position size before moving forward with a trade.

-

Understanding Forex Risk Management

The forex market is the most liquid and largest market in the world. However, like any other financial market, the forex market can also be risky during times of high volatility.

-

Hedging in Forex: How to Hedge Currency Risk

Forex hedging or currency hedging allows you to open multiple trade positions to offset any possible currency risk associated with your current position

-

What Is PIP in forex trading?

PIPs are essential in forex as they tell the traders about the size of profits or losses that can be made from a particular currency pair.

-

What Is Gap Trading?

Gaps in the Forex market help traders identify price movement clues, entry and exit signals, and trend reversals.

-

Top Swing Trading Indicators

Swing trading is all about profiting from market swings. It is a popular speculative strategy where traders tend to buy and hold their assets hoping to profit from expected market movement.

-

What are Support and Resistance Levels

Support and resistance levels in the Forex market allow traders to understand the market direction and predict future prices to consider in making trade decisions.

-

MT4 vs MT5: Which is Better?

MetaTrader is one of the most popular online trading platforms used globally and its two main versions are MetaTrader 4 and MetaTrader 5. But between MT4 and MT5, which is one best for you?

-

What is Forex?

The Forex market offers high liquidity and margin opportunities for you to trade and potentially profit off of exchange rates of currencies. With a daily volume of more than $6.6 trillion in 2019, it is the largest financial market in the world.

-

What is Leverage in Forex

Leverage allows traders to hold large positions in the Forex market with fewer capital. With leverage trading, traders can borrow money from a broker and hold larger positions, which in turn could magnify returns or losses.

-

How To Set a Stop Loss Order in Forex Trading

A stop loss order is used to prevent extensive losses, especially during severe market dip situations. By placing a stop loss order, you can automatically close your position if the market moves against you.

-

MetaTrader 5: The Complete Guide

MetaTrader 5, the powerful automated trading platform, offers advanced tools for successful trading analysis and trades in the financial markets. Aside from Forex, the MT5 platform helps you trade Stocks, CFDs, and Futures.

-

What is MetaTrader 4: The Complete Guide to MT4

An advanced trading platform, MT4 has become a norm for seasoned Forex traders as it helps them execute their trades even when their machine is off. It comes with a user-friendly interface, numerous technical analysis tools for forecasting market patterns, real-time currency price data, and much more.

-

What are Long and Short Positions in Forex?

In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders expect currency pair prices to increase in the future.

-

What is a Spread in Forex?

A spread is a cost built into the buying and the selling price of all the currency pairs. In most cases, Forex spreads depend on your Forex broker.

-

What is a Currency Pair in Forex?

The foreign exchange (Forex) market is the largest financial market in the world. With a daily average volume of about $6.6 trillion and worth over $2.4 quadrillion as of 2021, Forex is a decentralised global market for trading currencies.

-

How do you trade forex?

Many people want to get into Forex trading and make quick profits, but only a few even know how to start. While trading Forex online has now become easier than ever because of powerful platforms like Blueberry Markets, it can still feel incredibly overwhelming to get started with it.

-

When Can You Trade Forex?

In case you are wondering is Forex trading profitable, the short answer is yes. But many opt for Forex traders to make fast profits since Forex markets are operational 24 hours for five days a week.

-

Who trades forex?

Major players in the Forex market are financial institutions including commercial banks, central banks, money managers along with hedge funds. Many global corporations also trade in Forex to hedge currency risk.

-

Why trade forex?

As the largest financial market globally, Forex trading is one of the most popular investment avenues for many. The liquidity and huge trading volume make Forex trading an option worth exploring.

-

Forex Margin & Leverage

Forex trading usually provides much higher leverage compared to other financial instruments like stocks. This is one of the primary reasons why so many people are attracted to Forex, and more and more people have started to enter the Forex trading market.

-

Key steps to making your first trade in Forex

Making your first trade in Forex successfully requires in-depth knowledge about trading basics and Forex trading strategies. The learning curve to trading currencies can seem overwhelming and complex, but when you have the right information by your side, it can make the entire process all the more easier.

-

How is Forex regulated?

There are several Forex brokers in the Forex market, and amidst those thousands of Forex brokers, it can become nothing less than challenging for traders to find the best brokers.

-

Rollover rates

When you hold a currency spot position overnight, the interest you either earn or pay is the rollover amount. Each currency has a different overnight interbank interest rate, and because you trade Forex in pairs, you also deal with two different interest rates.

-

Tips for Forex trading beginners

In terms of trading volume, the Forex market is the largest financial market in the world. It is also the only financial market that operates round the clock every day.

Intermediate

Have a basic understanding of

Forex? Ready to level up? Move on

to the intermediate course.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.