What is MetaTrader 4:

The Complete Guide to MT4

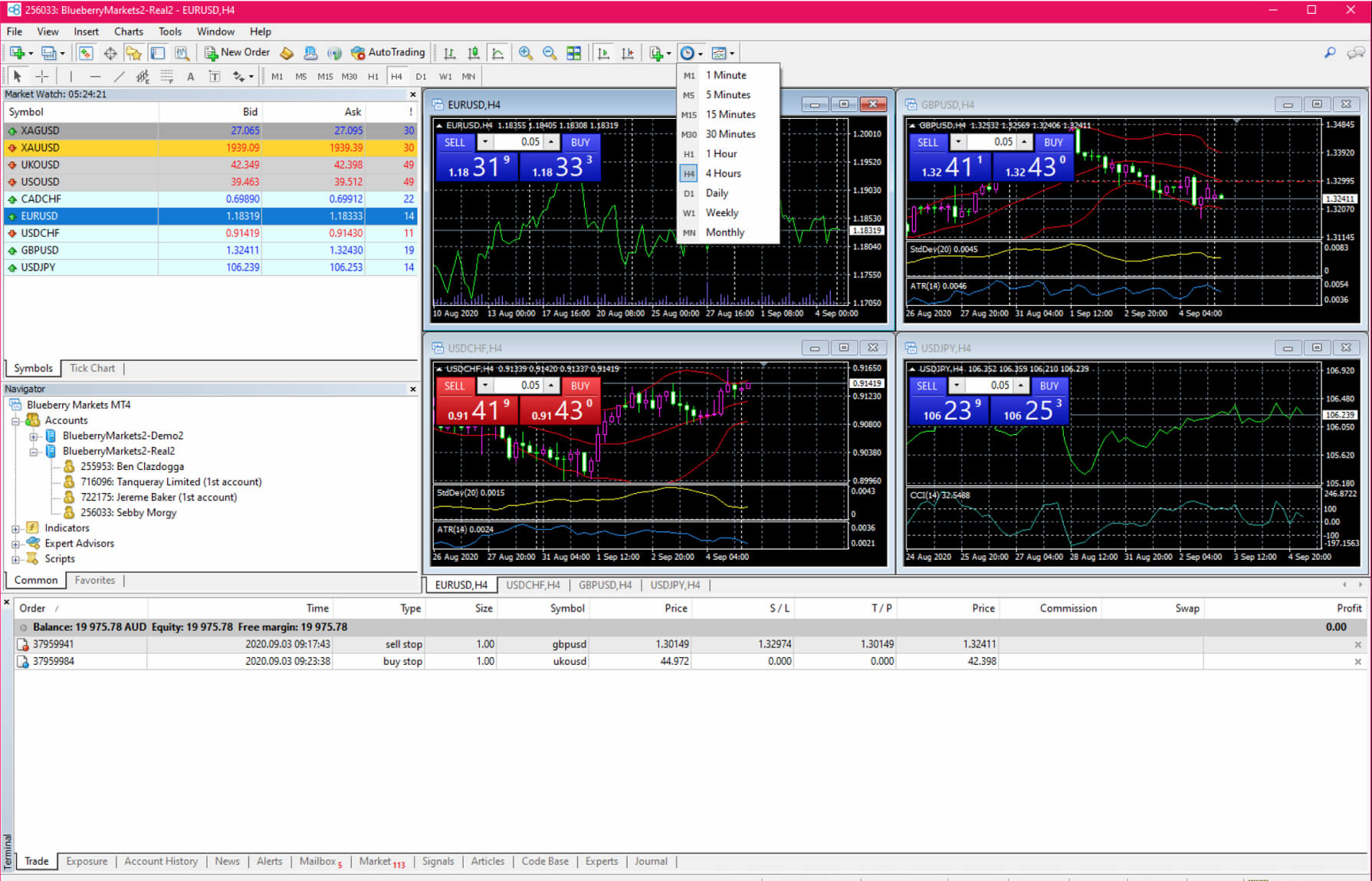

An advanced trading platform, MT4 has become a norm for seasoned Forex traders as it helps them execute their trades even when their machine is off. It comes with a user-friendly interface, numerous technical analysis tools for forecasting market patterns, real-time currency price data, and much more.

What is MetaTrader 4?

MetaTrader 4 is an advanced trading platform that can automate Forex and CFD trades. It can also closely analyse the markets. Developed by MetaQuotes in 2005, it is licensed to Forex brokers who can offer this platform to their clients for seamless trading.

Traders can use it to check live currency pair prices, charts, place orders, manage orders, and automate trades. The tool is free to download and gives traders access to a secure, fast and reliable trading environment.

Key features of MT4

Automated trading opportunity

Traders can automate their trade and leverage market movements without any manual intervention. In fact, traders can also use automated trading strategies with MT4 expert advisors. Expert Advisors or EA are strategic programs run on the MT4 platform, which help monitor and trade financial markets with systematic algorithms.

You can set your own EAs and technical indicators to suit your trading goals and objectives. You can then test and optimise your strategy through MT4’s Strategy Tester. The tester lets you know if the strategy you are doing will be useful in Forex trading or not.

Real-time market prices and liquidity access

MT4 allows you to access all Forex quotes in real-time and execute trades simultaneously. You can also view additional details about a currency pair, including its spread, margin, contract size, and the number of buy and sell orders.

If the bid is greater than the sell, the market trend is considered bullish. This enables the trader to increase their purchase of a particular currency pair due to the increased liquidity. This also helps them with short-term strategies like scalping.

Extensive price analysis tools

MT4 has several in-built charts and technical indicators along with extensive price analysis tools. There are over 30 indicators that include major volume and trend tools along with unlimited charts that can be viewed together. The platform displays currency pairs in nine different timeframes, ranging from minutes to monthly intervals.

It also allows traders to conduct an in-depth chart analysis with price analysis, mathematical tools, and drawing objects that help traders analyse all price-related activities. The charts are customised to suit each trader and their requirements. These charts help traders identify support and resistance levels, forecast price changes, define exit and entry points, and set the stop-loss levels in the Forex market.

High flexibility on multiple orders

With MT4, you can deal with two market orders, four pending orders, and three different trade execution modes together. Since everything on MT4 is automated, traders who do not wish to trade full time can opt for the same strategy.

Minimises slippage

Slippage happens when an executed market order or stop-loss order is closed at a different rate than what was set initially. This happens mostly in markets of high volatility and can lead to losses. However, MT4 comes with a lightning-fast execution and robust stability that helps in minimising the chances of this issue from happening.

Alert function

MT4 has an alert function that informs traders of significant price changes across financial markets. Any change in the national or global economy can result in dramatic changes in the market. This leads to volatile price movements that can result in losses. To protect you against these, MT4 sends an email and mobile alert notifications to update you on all price movements.

Automatic and algorithmic trading

With the EA’s function, there are several algorithms that you do on MT4. EAs come with a programming language that allows traders to create their own automated and algorithmic trading strategies.

Types of MetaTrader 4 indicators

Trend Indicators

Trend indicators are used to study and identify price trends of financial instruments in the market. Some examples include:

-

Bollinger Bands

Bollinger bands predict market security movements based on market volatility. -

Ichimoku Cloud

This indicator identifies momentum and trend direction and support and resistance levels through graphs that give an outline in four different time intervals. -

Standard Deviation

This indicator measures data dispersion around a specific value which further helps in calculating the data accuracy. -

Envelopes

Envelopes are formed when one of two Moving Averages shift upwards while the other moves downward. This indicator defines the upper and lower margins of the price range. -

Average Directional Movement Index (ADX)

ADX measures the strength of any trend based on the average of a currency pair’s price range expansion over a certain period.

Oscillator indicators

The oscillator indicators show the fluctuations in the market with upper and lower bonds providing oversold and overbought signals. Some examples include:

-

Force Index

This indicator measures the force of bulls during a rally and bears in a market’s downtrend. -

DeMarker (DeM)

The DeMarker measures the demand for an underlying asset by comparing current and previous price changes. -

Momentum

The momentum indicator defines the market strength by analysing how frequently the price changes as compared to the actual price. -

Relative Vigor Index (RVI)

The RVI measures the strength of a trend using Simple Moving Average. -

Relative Strength Index (RSI)

The RSI indicator calculates the momentum as a ratio between the highest closing prices and the lowest closing prices over a selected time. -

Stochastic oscillator

A stochastic oscillator works by comparing certain closing prices of securities to a range of their prices over a specific period. -

Williams’ Percent (W%R)

This is also a momentum indicator that indicates if an asset is oversold or overbought. It compares closing prices of the security over a specific time.

Volume indicators

Volume indicators define trading volumes and the quantity of security traded in a market over a specified period. A few examples of volume indicators are:

-

Accumulation/Distribution (A/D)

(A/D) analyses intraday price movements and determines if the market is accumulating or distributing, which is also known as a moment of pause. -

On Balance Volume (OBV)

This is an indicator that quantifies volume changes in the market to predict price movements. -

Money Flow Index (MFI)

MFI is an oscillator that uses price and volume to generate overbought and oversold signals.

Bill Williams Indicators

Bill William indicators are preferred by people following the methods of American trader and author, Bill Williams.

-

Williams Alligator

This indicator identifies sudden trends based on three Moving Averages that form the jaw, teeth, and lips of the alligator. -

Gator Oscillator

This indicator is aimed to detect if a market is in trend or consolidating. This helps traders identify ideal entry and exit points. -

Awesome Oscillator

This indicator is a type of oscillator comparing momentums of several periods together and reflecting the changes in the market by identifying trend strengths, formations, and reversals. -

Accelerator Oscillator (AO)

AO measures the momentum of a market and confirms trends for possible reversals. -

Market Facilitation Index (MFI)

MFI shows the strength of the varying prices of a particular security in a given period.

How do you trade on MT4?

1. Sign up with a Forex broker supporting MT4

Use MT4 by signing up with Blueberry Markets. Once your account is set up, you can immediately open trades using MT4.

2. Download MT4

You can download MT4 for Windows, Mac, Android, or access it from the web. Log in with the credentials you used to sign up with Blueberry Markets.

3. Open your first position

MT4 will show an order window where you can place your order. For one-click order placement, press F9 and fill the components like symbol, volume, take profit, stop loss, comment, and type. Your order is instantly executed based on the order type you choose.

4. Monitor current and pending orders

You can monitor all your open and pending positions in the terminal window. Press Ctrl + T or click on View in the toolbar. Then, select the Trade tab. Closing a position or deleting an order with MT4 comes easy with a single click.

5. Modify orders

You can also modify your orders on open and pending positions. Open the terminal window and visit the Trade tab again, right-click the position or pending order you want to change, and click on Modify or Delete the order.

6. Customise charts

You can draw on the charts, add indicators, and even edit indicators when required. MT4 also allows you to change the time frame of a particular price chart with one click.

7. Set up price alerts

You can set up price alerts by opening the terminal window and going to the Alerts tab. Right-click on the window and click Create. This will give you an alert editor where you can completely customise price alerts for currency pairs.

8. View trade history and download trade reports

Viewing trade history on MT4 is easy as all you have to do is click on the Terminal window and go to the Account History tab. After you have gone through your trade history, you can also download trade reports for specific periods. The reports give details on individual trades and an account summary with metrics like drawdowns and profit factors.

Automate trades seamlessly with MT4

Blueberry Markets gives you access to MT4 if you sign up for a live or demo account with us.

We allow our traders to customise everything from charts and strategies to indicators with a single click.

Sign up today to make the most out of the benefits of trading on MT4.

Recommended Topics

-

Habits of Forex Traders

Forex trading requires discipline, focus, and a strong understanding of market trends.

-

Forex Trading Opportunities When Markets are Closed over Weekends

The forex market can be operated 24/7 Monday to Friday.

-

How to Calculate Forex Position Sizing

Each trader in the forex market defines their position size before moving forward with a trade.

-

Understanding Forex Risk Management

The forex market is the most liquid and largest market in the world. However, like any other financial market, the forex market can also be risky during times of high volatility.

-

Hedging in Forex: How to Hedge Currency Risk

Forex hedging or currency hedging allows you to open multiple trade positions to offset any possible currency risk associated with your current position

-

What Is PIP in forex trading?

PIPs are essential in forex as they tell the traders about the size of profits or losses that can be made from a particular currency pair.

-

What Is Gap Trading?

Gaps in the Forex market help traders identify price movement clues, entry and exit signals, and trend reversals.

-

Top Swing Trading Indicators

Swing trading is all about profiting from market swings. It is a popular speculative strategy where traders tend to buy and hold their assets hoping to profit from expected market movement.

-

What are Support and Resistance Levels

Support and resistance levels in the Forex market allow traders to understand the market direction and predict future prices to consider in making trade decisions.

-

MT4 vs MT5: Which is Better?

MetaTrader is one of the most popular online trading platforms used globally and its two main versions are MetaTrader 4 and MetaTrader 5. But between MT4 and MT5, which is one best for you?

-

What is Forex?

The Forex market offers high liquidity and margin opportunities for you to trade and potentially profit off of exchange rates of currencies. With a daily volume of more than $6.6 trillion in 2019, it is the largest financial market in the world.

-

What is Margin trading?

Margin trading is one of the most common derivative strategies used in financial markets. It can also be considered tax-efficient as it allows you to choose the size of your wager and exempts profits earned from stamp duties and taxes.

-

What is Leverage in Forex

Leverage allows traders to hold large positions in the Forex market with fewer capital. With leverage trading, traders can borrow money from a broker and hold larger positions, which in turn could magnify returns or losses.

-

How To Set a Stop Loss Order in Forex Trading

A stop loss order is used to prevent extensive losses, especially during severe market dip situations. By placing a stop loss order, you can automatically close your position if the market moves against you.

-

MetaTrader 5: The Complete Guide

MetaTrader 5, the powerful automated trading platform, offers advanced tools for successful trading analysis and trades in the financial markets. Aside from Forex, the MT5 platform helps you trade Stocks, CFDs, and Futures.

-

What are Long and Short Positions in Forex?

In Forex trading, you can take long or short positions based on expectations of the market rising or falling. Long or buy positions are maintained when traders expect currency pair prices to increase in the future.

-

What is a Spread in Forex?

A spread is a cost built into the buying and the selling price of all the currency pairs. In most cases, Forex spreads depend on your Forex broker.

-

What is a Currency Pair in Forex?

The foreign exchange (Forex) market is the largest financial market in the world. With a daily average volume of about $6.6 trillion and worth over $2.4 quadrillion as of 2021, Forex is a decentralised global market for trading currencies.

-

How do you trade forex?

Many people want to get into Forex trading and make quick profits, but only a few even know how to start. While trading Forex online has now become easier than ever because of powerful platforms like Blueberry Markets, it can still feel incredibly overwhelming to get started with it.

-

When Can You Trade Forex?

In case you are wondering is Forex trading profitable, the short answer is yes. But many opt for Forex traders to make fast profits since Forex markets are operational 24 hours for five days a week.

-

Who trades forex?

Major players in the Forex market are financial institutions including commercial banks, central banks, money managers along with hedge funds. Many global corporations also trade in Forex to hedge currency risk.

-

Why trade forex?

As the largest financial market globally, Forex trading is one of the most popular investment avenues for many. The liquidity and huge trading volume make Forex trading an option worth exploring.

-

Forex Margin & Leverage

Forex trading usually provides much higher leverage compared to other financial instruments like stocks. This is one of the primary reasons why so many people are attracted to Forex, and more and more people have started to enter the Forex trading market.

-

Key steps to making your first trade in Forex

Making your first trade in Forex successfully requires in-depth knowledge about trading basics and Forex trading strategies. The learning curve to trading currencies can seem overwhelming and complex, but when you have the right information by your side, it can make the entire process all the more easier.

-

How is Forex regulated?

There are several Forex brokers in the Forex market, and amidst those thousands of Forex brokers, it can become nothing less than challenging for traders to find the best brokers.

-

Rollover rates

When you hold a currency spot position overnight, the interest you either earn or pay is the rollover amount. Each currency has a different overnight interbank interest rate, and because you trade Forex in pairs, you also deal with two different interest rates.

-

Tips for Forex trading beginners

In terms of trading volume, the Forex market is the largest financial market in the world. It is also the only financial market that operates round the clock every day.

Intermediate

Have a basic understanding of

Forex? Ready to level up? Move on

to the intermediate course.

Guide to Forex

Trading indicators.

Enter your details to get a copy of our

free eBook

Start a risk free

demo account

News & Analysis

Catch up on what you might

have missed in the market.